Millennium Media promises to bring more success for your business. Seal the deal with us at the lowest market price & yield huge profits. Our company is an eight-year-old establishment that works as an advertiser for all types of business. Located in the beautiful location of Sydney CBD [Central Business Park] our employees are pleased to offer services to the clients.

The companies are offering services at the Melbourne Media Agency at a high rate. But, we are providing a number of facilities at the cost of few. Our success lies beneath fair work system, dedicated employees & trust of the clients. We have promoted all types and scales of businesses, including the Bond Cleaning in Melbourne, which possesses a highly-talented team of the local cleaners who perform toughest end of lease cleaning Melbourne tasks with ease. Our expertise and creative potential took their business to the next level of success. If you also want to build a strong brand image, hire our media agency. We believe in making the country a local market, where the sellers can sell off their products directly to the buyers.

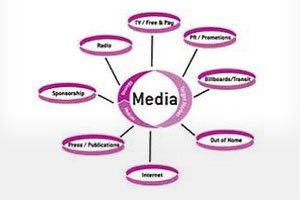

Millennium Media is a network of more than forty people, who constantly work towards making the client’s business successful. Also, we care for business expansion. Our professionals carry out a detailed report of:-